Author: Nextwebi HealthTech Practice

Edition: 2025

Audience: CXOs, CIOs/CTOs, Medical Directors, Product Owners, and Digital‑Health Entrepreneurs

Executive Summary

Healthcare IT (HIT) is expanding at a mid‑teens CAGR powered by interoperability mandates, AI/analytics, telehealth, cloud migration, and revenue‑cycle optimization. Budgets are shifting from standalone systems to integrated platforms that unify clinical, operational, and patient‑facing journeys. A prudent cost envelope for net‑new enterprise‑grade solutions in 2025 ranges from $150K to $2M+ depending on scope, with annual run costs at 15–25% of build CapEx. Buyers should prioritize FHIR‑first architectures, zero‑trust security, phased MVP delivery, and measurable ROI in 6–12 months.

At a glance – Top priorities: interoperability, data security, clinician workflow automation, patient access, and care-at-home. – Fastest‑growing stacks: cloud‑native microservices, FHIR/SMART APIs, event‑driven data pipelines, AI copilots for admin & clinical decision support. – Key risks: compliance drift, integration complexity, under‑budgeted change management, cyber exposure. – Winning playbook: discover → MVP in 90–120 days → scale with reusable modules → measure outcomes (denials cut, LOS reduction, no‑show reduction, faster cash).

What Counts as “Healthcare IT Solutions” in 2025

Healthcare IT is broader than EHRs. It spans clinical, operational/financial, and patient‑facing layers. A modern stack commonly includes:

- Core Clinical Systems

EHR/EMR and ancillary (LIS, RIS/PACS, pharmacy, LIMS)

• Care coordination & care‑management

• ePrescribing, eMAR, medication safety

• Clinical decision support (CDS), pathways, order sets - Patient & Provider Experience

Telehealth/virtual care, remote patient monitoring (RPM)

• Patient portals, mobile apps, PHRs, digital front door (check‑in, queueing, payments, wayfinding)

• Engagement (reminders, campaigns), PROs/assessments - Operational & Financial

Revenue Cycle Management (RCM): scheduling, eligibility, coding, denials, collections

• ERP/supply chain, OR/bed Mgmt, staffing/rosters

• Population health, value‑based care, registries

• Analytics/BI, data warehouses, actuarial models - Data, Integration & Platform

FHIR/HL7 integration, interoperability engines

• Master patient index (EMPI), consent/identity, audit

• Data lakes/mesh, event streaming, observability

• Security, privacy, and compliance tooling

Market Growth Snapshot

- Global healthcare IT spend continues to grow at a mid‑teens CAGR through 2030+ driven by: regulatory interoperability, cloud economics, AI at point‑of‑care, and RCM automation.

- North America leads overall adoption; Europe accelerates with the European Health Data Space; India advances nationwide rails via ABDM/UHI.

- Sub‑segments with the highest momentum: digital front door, telehealth & RPM, AI‑enabled RCM, population analytics, cloud infrastructure, and cybersecurity.

Why Now: The Five Structural Drivers

- Interoperability mandates → Open APIs (FHIR/SMART), USCDI data expansion, EU cross‑border exchange, India’s ABDM rails.

- Care beyond hospital walls → telehealth, virtual wards, home diagnostics & chronic care.

- Workforce pressure → automation for coding, documentation, prior auth, and clinical in‑basket triage.

- Payment reform → value‑based models reward coordination, risk stratification, and outcomes.

- Cyber resilience → ransomware & third‑party risk necessitate zero‑trust, continuous compliance, immutable backups.

Solution Archetypes & Typical Cost Envelopes (2025)

Note: Ranges include design, build, integration, testing, and initial compliance hardening. Enterprise deployments, multi‑region rollouts, and regulated device workflows skew higher. All figures indicative.

- Patient Access & Engagement (digital front door, portal, mobile app, messaging, self‑scheduling)

• Scope: identity & consent, appointment management, reminders, payment, forms, basic teleconsults.

• Build cost: $120K–$400K

• Timeline: 3–6 months for MVP; 6–9 months for scale

• Annual run (cloud, support, updates): 15–22% of build - Telehealth & Remote Care (video, asynchronous consults, RPM, device feeds)

• Scope: HIPAA‑grade video, vitals ingestion, alerting, device/kit integration, patient triage, notes to EHR.

• Build cost: $180K–$600K

• Timeline: 4–8 months

• Run cost: 18–25% - RCM Modernization (eligibility, coding, claims, denials automation, patient financials)

• Scope: clearinghouse integration, payer APIs, AI‑assisted coding, rules engine, analytics.

• Build cost: $250K–$900K

• Timeline: 6–9 months

• Run cost: 18–25% - Integration Platform (FHIR‑first)

• Scope: FHIR/HL7 gateway, EMPI, consent, audit, mapping toolkits, event bus (ADT/ORM/ORU), bulk data.

• Build cost: $160K–$700K

• Timeline: 4–8 months

• Run cost: 15–22% - Analytics & Population Health

• Scope: data lake/warehouse, data quality pipelines, cohorting, risk scores, dashboards; privacy preserving analytics.

• Build cost: $220K–$1.2M+

• Timeline: 6–12 months

• Run cost: 18–25% - Hospital/Lab Core Extensions (LIS, RIS/PACS integrations, order-to-result flows)

• Scope: modality worklists, results routing, e‑prescription, lab workflows, device integration.

• Build cost: $200K–$800K

• Timeline: 6–10 months

• Run cost: 18–25%

Rule of thumb (TCO): Initial build CapEx × 0.18–0.22 ≈ first‑year OpEx for cloud, security, compliance upkeep, and product increments.

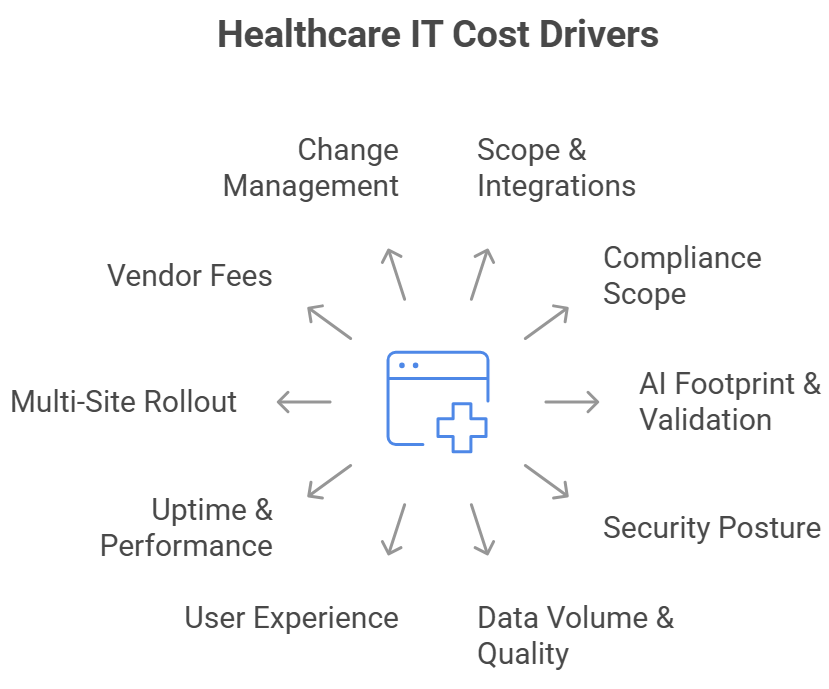

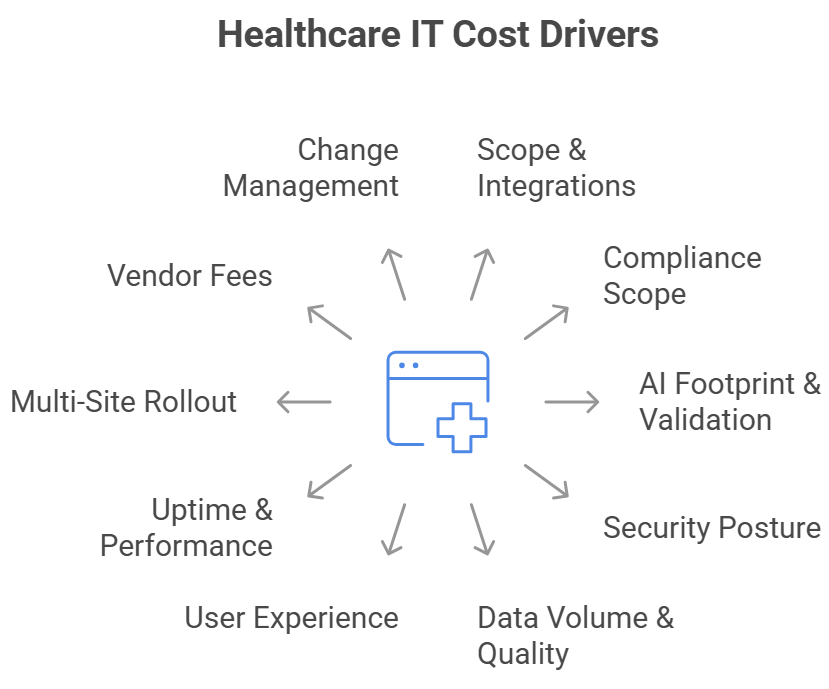

Cost Drivers You Must Model Upfront

- Scope & Complexity: number of modules, integrations, and regulated workflows (e.g., eRx, eMAR).

- Interoperability Surface: count of EHRs (Cerner/Oracle, Epic, OpenMRS), labs, devices, and payer connections.

- Data & Analytics: volume/velocity, historical loads, SDOH, risk models, PHI minimization.

- AI Footprint: level of automation (coding, triage, summarization), model governance and validation workload.

- Security Assurances: zero‑trust, encryption, logging, DLP, immutable backups, tabletop exercises.

- Compliance: HIPAA/42 CFR Part 2, ONC certification touchpoints, USCDI/FHIR conformance, EU GDPR/EHDS, India PDP/ABDM.

- Change Management: training, SOP updates, clinical adoption, dual‑running legacy.

- SLA & Availability: multi‑AZ/region, RTO/RPO, high‑throughput video/streaming, observability.

- User Experience: clinician‑grade UX reduces burnout and rework—often the highest ROI lever.

- Vendor Strategy: buy vs build, per‑use fees (video, SMS, e‑fax), and exit costs.

Architectural Blueprint (What “Good” Looks Like)

Principles

– FHIR‑first APIs and data contracts as the canonical schema; map HL7 v2, X12, DICOM at the edge.

– Domain‑driven microservices with event‑streaming (ADT, order, result, claim) and idempotent processors.

– Data platform with lakehouse or data mesh; PHI minimization, tokenization, and consent‑aware access.

– Zero‑trust security: least privilege, continuous posture, strong identity (MFA, device hygiene), private endpoints.

– Observability across apps, integrations, and data jobs; SLOs for latency and data freshness.

Reference Modules

– API Gateway (REST/GraphQL), FHIR Server, Identity (OIDC/OAuth2), Consent & Audit, EMPI

– Integration Engine (HL7 v2/DICOM/X12 translators)

– Event Bus (Kafka/Kinesis), Job Orchestrator (Airflow), CDC

– Analytics (DBT/Spark), BI/Insights, Feature Store (for ML)

– Security Tooling (SIEM/SOAR, EDR, WAF, secrets management)

Interoperability Targets

– SMART on FHIR launch for third‑party apps; EHR side‑panel experiences

– Bulk FHIR for cohort ops; USCDI alignment; IHE profiles for imaging

– Payer APIs for eligibility, prior auth, claims; CAQH CORE rules

Security & Compliance Essentials (Clinically Safe, Audit‑Ready)

Security Baseline

– Zero‑trust network; encrypted at rest/in transit; secrets rotation

– Segmented data zones; immutable/offline backups; ransomware drills

– Third‑party risk management; SBOM & supply‑chain hygiene

– Continuous vulnerability management; SIEM with anomaly detection

Privacy & Compliance Guardrails

– HIPAA/HITECH, GDPR/EHDS, India’s DPDP Act + ABDM policies

– Access governance: role‑based + attribute‑based, consent capture, purpose of use

– AI governance: model cards, bias testing, clinician‑in‑the‑loop, audit trails

– Logging & retention mapped to regional laws; breach notification playbooks

Operational Proof

– Security scorecards, control mapping (NIST CSF/ISO 27001), quarterly exec reporting

– Vendor due diligence kits, DPIAs, DSR processes, data maps

Regulatory Landscape You Must Plan For

- United States: Interoperability mandates (information sharing, open APIs), USCDI v4 data expansion; certification and algorithm transparency updates; payer/provider API ecosystems and prior authorization modernization.

- European Union: European Health Data Space (EHDS) enables primary and secondary use of health data with harmonized rights and obligations; phased implementation from 2025 onward; strong GDPR alignment and cross‑border exchange standards.

- India: Ayushman Bharat Digital Mission (ABDM) and UHI establish national registries, ABHA identities, consent‑based data exchange, and digital public infrastructure, catalyzing provider digitization and patient access.

Implication for buyers: Your architecture should be policy‑evolvable—i.e., able to absorb new data classes, consent rules, and reporting without re‑platforming.

Detailed Cost Breakdown Templates

Use these as mix‑and‑match templates to shape a precise SOW. Percentages reflect typical allocations for a net‑new enterprise module.

1) Productized Module (e.g., Telehealth MVP ~ $350K)

– Discovery, compliance, and UX research — 8–12%

– UI/UX design system & accessibility — 7–10%

– Frontend (web/mobile) — 18–24%

– Backend services & APIs — 18–24%

– Integrations (EHR, payments, messaging, video) — 12–18%

– Security hardening & privacy engineering — 6–10%

– QA (functional, security, performance) — 8–12%

– DevOps/Cloud infra & IaC — 6–9%

– Program management & training — 5–8%

2) Integration Platform (FHIR Gateway ~ $450K)

– Data modeling & mapping (HL7 v2↔FHIR, X12, DICOM) — 20–25%

– API gateway & FHIR server setup — 12–18%

– Event streaming & orchestration — 10–15%

– Identity, consent & audit — 10–12%

– EMPI & patient identity resolution — 8–12%

– Observability & reliability engineering — 8–10%

– Security controls & compliance automation — 8–10%

– QA & performance testing — 6–10%

– PM & change management — 5–8%

3) Analytics & Population Health (Lakehouse ~ $900K)

– Data ingestion & quality pipelines — 20–25%

– Lakehouse/warehouse build — 15–20%

– Privacy-preserving analytics (de‑identification, tokenization) — 8–12%

– Clinical & financial dashboards — 10–14%

– Risk stratification models — 10–14%

– Governance & catalog — 6–10%

– Reliability/FinOps — 6–10%

– Program & adoption — 5–8%

Ongoing (annual): Cloud/hosting, monitoring, incident response, compliance reviews, vulnerability mgmt, roadmap increments, support SLAs.

Build vs Buy (and the Hybrid Reality)

Buy when functionality is commodity or regulated (e.g., e‑prescribing gateways, video, SMS, clearinghouse).

Build when workflows are your differentiator (e.g., specialty pathways, patient experiences, analytics logic).

Hybrid is typical: platform core + configurable apps + edge customizations.

Evaluation checklist

– API maturity and FHIR coverage

– Data portability (export, Bulk FHIR, eventing)

– Security attestations (SOC 2/ISO 27001/HITRUST)

– Roadmap transparency and SLAs

– Total cost of ownership vs lock‑in risk

Delivery Roadmap (Phased, Outcome‑Anchored)

Phase 0 – Strategy & Readiness (2–6 weeks)

– Current‑state assessment, Risk & Compliance Plan, architecture runway

– Value hypotheses & KPIs (e.g., deny rate ↓, DSO ↓, no‑shows ↓)

Phase 1 – MVP (12–16 weeks)

– Prioritize a single patient or clinician journey

– Wireframes → design system → build the thin slice

– Integrate identity, consent, audit, core EHR/RCM interfaces

– Release to a pilot cohort; bake in analytics and A/B levers

Phase 2 – Scale (3–6 months)

– Add integrations, device feeds, payer APIs

– Improve resilience, observability, and model governance

– Expand to additional sites/specialties; enable self‑serve configuration

Phase 3 – Optimize (Continuous)

– Denials automation, throughput tuning, cloud FinOps

– Quarterly security posture reviews, tabletop exercises

– Roadmap increments tied to measured outcomes

ROI Models & Business Cases (Practical Examples)

- No‑show reduction: automated reminders + digital check‑in → 2–5% improvement in visit completion → lifts provider revenue and lowers idle time.

- Denial prevention: eligibility + coding AI + rules → cut first‑pass denials by 15–30%, accelerate cash.

- Clinician time: documentation assist & in‑basket triage → save 5–15 min/visit, ease burnout.

- Bed management: ADT‑driven orchestration and predictive LOS → 1–2% throughput gain in acute care.

- Inventory & implant tracking: UDI, RFID/RTLS feeds → reduce loss/expiry by 10–20%.

Tie each initiative to a baseline, instrument KPIs from day one, and revisit quarterly. Finance and clinical operations should co‑own the value ledger.

AI in Healthcare IT (Safe, Useful, Governed)

High‑impact use cases

– Ambient scribe & summarization

– Coding assistance & CDI

– Prior authorization triage

– Care gaps & risk detection

– Patient support (education, FAQs, intake)

– Forecasting: volumes, staffing, readmission risk

Guardrails

– Human‑in‑the‑loop for clinical impact

– Model cards & dataset provenance; PHI minimization

– Bias tests, drift monitoring; explainability where material

– Access controls + audit across prompts, responses, and training data

Build blocks

– Feature store tied to lakehouse

– Prompt libraries & evaluation harness

– Batch & real‑time inference, shadow mode before go‑live

Regional Notes for Buyers

United States

– Ensure your solutions align with open API and information‑sharing rules; track USCDI updates; plan for certification touchpoints where relevant (e.g., patient access APIs).

– Payer connectivity and prior auth modernization are accelerating — design for eligibility, claims, data‑exchange, and attachments.

European Union

– Plan for EHDS phased rollout and secondary data use; strengthen consent, logging, and auditability; align vendor contracts to data‑processing roles under GDPR.

India

– Leverage ABDM registries (HPR, HFR), ABHA numbers, and consent manager rails; build UHI‑ready endpoints; align with India’s DPDP Act.

Team Composition & Engagement Models

Typical squad for a hospital/provider build

– Product Manager, Delivery Lead, Solution Architect

– UX Lead + Designer

– Frontend (Web &/or Mobile), Backend/API engineers

– Data/Integration engineer, FHIR/HL7 specialist

– SRE/DevOps engineer

– Security & Compliance analyst

– QA (functional, automation, performance, security)

Engagement patterns

– Fixed‑scope for well‑defined modules/MVPs

– Time & materials for discovery/integration‑heavy programs

– Managed service for Ops, security, and compliance run

Procurement & Governance Tips

- Run a discovery sprint before final SOW to de‑risk assumptions.

- Demand API catalogs (FHIR coverage, events), data export, and change‑log transparency.

- Bake security & privacy acceptance criteria into every story.

- Mandate observability: trace IDs across UI → API → integration → data jobs.

- Require runbooks (major incident, data breach, downtime procedures).

- Include exit provisions: data formats, escrow, and migration support.

Buyer’s FAQ (2025)

Q1. How long does an enterprise HIT project take?

MVPs: 3–4 months. Scale‑outs: 6–12 months. Multi‑hospital programs: 12–24 months with staged go‑lives.

Q2. What’s the most common budget miss?

Underestimating integrations and change management. Budget 20–30% of build for integrations; reserve 10–15% for training, SOPs, and adoption.

Q3. What about vendor lock‑in?

Protect yourself with FHIR‑first data contracts, Bulk FHIR exports, event logs, and termination clauses that guarantee data egress.

Q4. How do we keep AI safe?

Require clinical oversight, dataset governance, access controls, red‑teaming, and audit trails.

Q5. What compliance certs matter?

SOC 2 Type II/ISO 27001 for suppliers; HITRUST where applicable. Map to HIPAA, GDPR/EHDS, DPDP.

Q6. How do we start if we’re legacy‑heavy?

Stand up an interoperability facade (FHIR gateway + event bus), then peel domains off the monolith into microservices.

Q7. What ROI should we expect?

Denials reduction, improved throughput, fewer no‑shows, shorter DSO, clinician time saved. Establish a baseline and measure quarterly.

How Nextwebi Can Help (Engagement Examples)

- Interoperability Gateway: FHIR facade over mixed EHRs; SMART app launch; consent & audit; Bulk FHIR.

- Digital Front Door: self‑scheduling, check‑in, remote forms, payments, reminders; ADA/WCAG‑compliant.

- RCM Intelligence: eligibility automation, coding assist, denials workbench with AI; payer API integrations.

- Population Analytics: lakehouse with SDOH, risk strat, quality dashboards; privacy‑preserving analytics.

- Virtual Care & RPM: device ingestion, alerts, pathways, documentation to EHR; clinician command center.

- Security & Compliance: zero‑trust baselines, SOC 2/ISO 27001 readiness, runbooks and drills, continuous compliance.

Delivery models: fixed‑scope MVPs, co‑build squads, or managed run.

Outcome focus: measurable clinical, financial, and operational gains.

Closing Note

Healthcare IT success in 2025 rewards teams that integrate open standards, secure data, pragmatic AI, and thoughtful change management. Start with one journey, instrument it well, and scale from a strong architectural core. Nextwebi brings the engineering depth, compliance rigor, and product mindset to make that real.

This guide provides directional benchmarks and best‑practice patterns. For a tailored plan with precise estimates, integrations, and milestones, contact Nextwebi’s HealthTech Practice.